What is a Tax Identification Number (TIN)?

A Tax Identification Number (TIN) is a unique identification number assigned to individuals and businesses for tax purposes. In Rhode Island, the TIN is also known as the Employer Identification Number (EIN). It is issued by the Internal Revenue Service (IRS) and is used to identify taxpayers and track their tax obligations.

Why is a TIN needed in Rhode Island?

A TIN is necessary in Rhode Island for various reasons. Firstly, it is required for businesses that operate as an employer, partnership, corporation, or sole proprietorship. It is also needed to open a business bank account, apply for business licenses and permits, and to file federal and state taxes. Additionally, obtaining a TIN helps protect against identity theft by providing a unique identifier for tax purposes.

Who needs to obtain a TIN in Rhode Island?

In Rhode Island, anyone who operates a business as an employer, partnership, corporation, or sole proprietorship is required to obtain a TIN. This includes individuals or entities engaged in activities such as selling goods or services, hiring employees, or conducting business transactions that generate taxable income. Even if a business does not have employees, obtaining a TIN is still necessary for tax reporting purposes.

Step-by-step process for obtaining a TIN in Rhode Island

-

Determine eligibility: Before applying for a TIN in Rhode Island, ensure that you meet the criteria for obtaining one. Individuals or businesses that engage in taxable activities are generally eligible.

-

Gather required documents: Collect the necessary documents for the TIN application, including personal identification, business entity documents (if applicable), and any supporting materials required by the IRS.

-

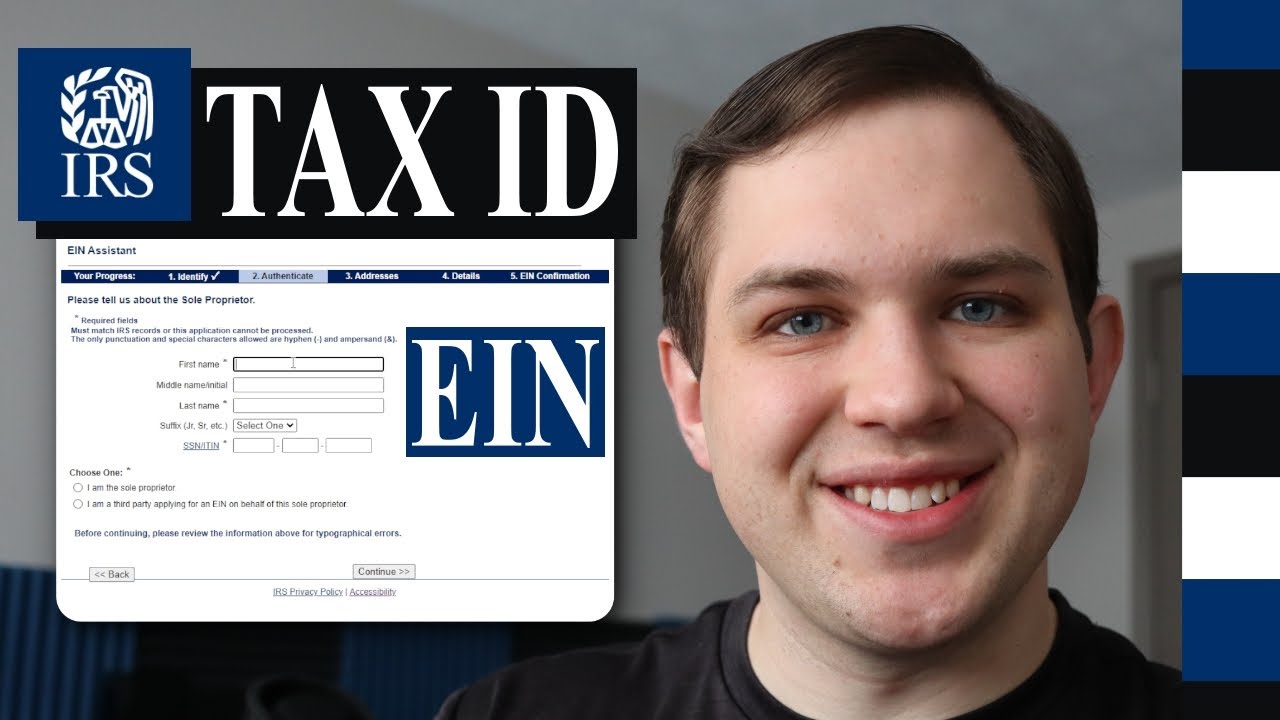

Complete Form SS-4: Fill out Form SS-4, Application for Employer Identification Number. This form can be obtained from the IRS website or by contacting the IRS directly.

-

Verify accuracy: Double-check all the information provided on the application form to ensure its accuracy. Mistakes or omissions may delay the processing of the application.

-

Submit the application: Send the completed Form SS-4 to the IRS. The application can be submitted online, by mail, or fax, depending on the preferred method chosen by the applicant.

-

Pay the necessary fees: Determine if any fees are required for obtaining a TIN in Rhode Island. Some entities may be exempt from fees, while others may have to pay a processing fee. Ensure that all fees are paid promptly to avoid delays in processing.

-

Await processing: After submitting the TIN application, allow time for the IRS to process it. The processing time may vary, so it is advisable to submit the application well in advance of any tax filing or business requirements.

-

Receive the TIN: Once the application is processed and approved, the IRS will issue a TIN to the applicant. The TIN will be sent via mail or provided online, depending on the chosen method of delivery.

-

Understand the importance of the TIN: The TIN is a crucial identifier for tax purposes in Rhode Island. It should be used on all tax-related documents, filings, and communications with the IRS and other relevant government agencies.

-

Keep the TIN secure: Protect the TIN by keeping it secure and sharing it only with authorized individuals or entities. Safeguarding the TIN helps prevent identity theft and ensures the accurate reporting and payment of taxes.

Gathering the required documents for a TIN application

To apply for a TIN in Rhode Island, certain documents are necessary. These typically include personal identification documents such as a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) for individuals, and business entity documents for businesses. The exact documents required may vary depending on the applicant’s specific circumstances, so it is advisable to consult the IRS website or seek professional assistance for guidance.

Where to submit a TIN application in Rhode Island

TIN applications can be submitted to the IRS through various channels. The preferred method is to apply online through the IRS website. Alternatively, applications can be mailed directly to the IRS or faxed, depending on the applicant’s convenience and preference. The specific addresses and fax numbers for submitting TIN applications can be found on the IRS website or by contacting the IRS directly.

Completing the TIN application form accurately

Accuracy is crucial when completing the TIN application form. Ensure that all information provided is correct, including personal details, business entity information (if applicable), and relevant supporting documentation. Any errors or omissions may result in delays in processing the application. It is recommended to review the instructions provided with the application form and seek professional advice if needed to ensure accuracy and completeness.

Paying the necessary fees for a TIN in Rhode Island

In Rhode Island, certain entities may be required to pay a fee for obtaining a TIN. However, some types of organizations may be exempt from fees. It is essential to determine whether a fee is applicable and, if so, the amount required. Fees can be paid using various methods, including electronic payments, checks, or money orders. Ensure that all fees are paid promptly to avoid delays in processing the TIN application.

Timelines for processing TIN applications in Rhode Island

The processing time for TIN applications in Rhode Island can vary depending on various factors, including the method of submission and the volume of applications being processed by the IRS. Generally, applications submitted online are processed faster than those submitted by mail or fax. It is advisable to submit the TIN application well in advance of any tax filing or business requirements to allow for sufficient processing time.

Receiving the TIN and its importance

Once the TIN application is processed and approved, the IRS will issue a TIN to the applicant. The TIN will be sent via mail or provided online, depending on the chosen method of delivery. The TIN is vital for tax compliance purposes and should be used on all tax-related documents, filings, and communications with the IRS and other relevant government agencies. It is a unique identifier that helps streamline tax processes and ensures accurate reporting and payment of taxes.

How to update or make changes to a TIN in Rhode Island

In Rhode Island, if any changes or updates need to be made to a TIN, the IRS should be notified promptly. Changes may include modifications to business structure, address, or contact information. To update or make changes to a TIN, complete Form SS-4 with the updated information and submit it to the IRS using the appropriate submission method. It is important to keep the TIN information current and accurate to ensure smooth tax compliance and communication with the IRS.

Additional resources and support for TIN applicants in Rhode Island

For additional resources and support regarding TIN applications in Rhode Island, applicants can visit the IRS website at www.irs.gov. The website provides comprehensive information on TIN requirements, forms, fees, and processing timelines. The IRS also offers assistance through its toll-free helpline, where applicants can get answers to specific questions or clarifications regarding the TIN application process. Additionally, professional tax advisors and consultants can provide guidance and support for TIN applicants, ensuring a smooth and hassle-free application experience.