Introduction to Unemployment Pay in Rhode Island

Unemployment pay plays a vital role in providing financial stability to individuals who face job loss in Rhode Island. The state’s Unemployment Insurance Program aims to assist eligible workers by providing temporary financial assistance until they can secure new employment. This article will explore the various aspects of unemployment pay in Rhode Island, including eligibility requirements, benefit calculation methods, and the duration and taxation of benefits.

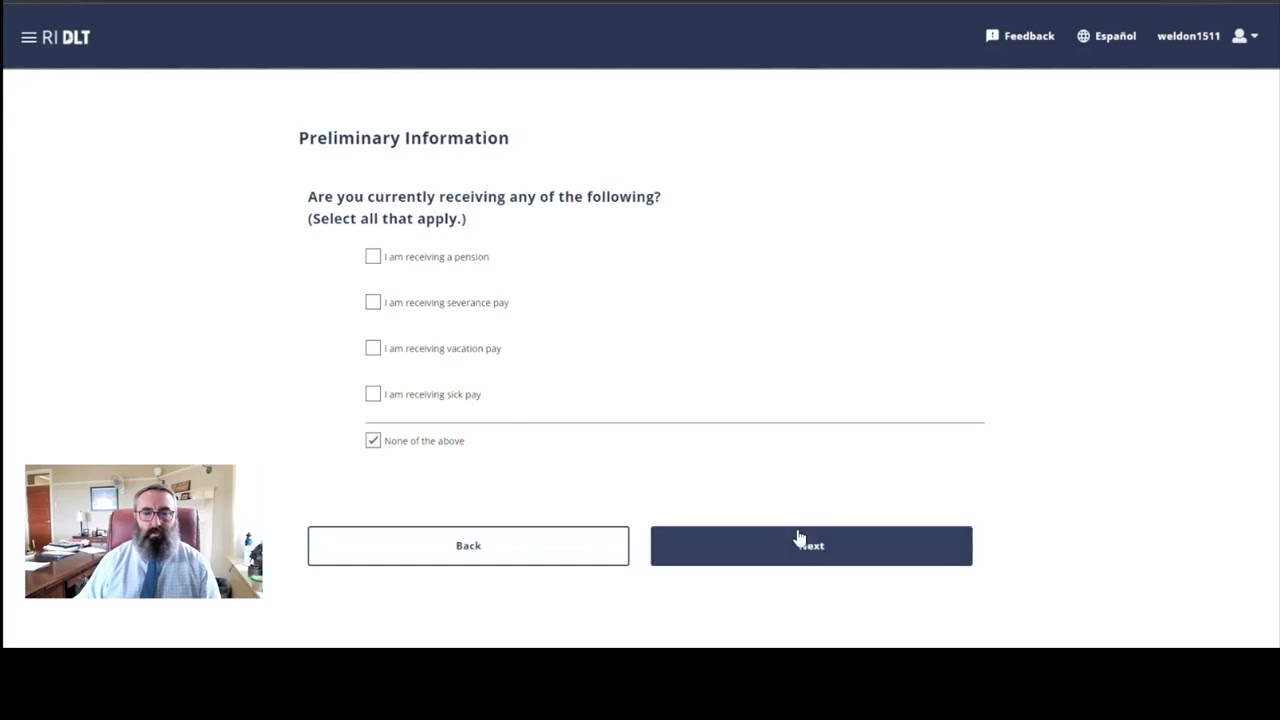

Understanding the Unemployment Insurance Program

The Unemployment Insurance Program in Rhode Island is administered by the Department of Labor and Training (DLT). The program is funded through employer payroll taxes and offers temporary financial assistance to workers who lose their jobs through no fault of their own. This program aims to provide a safety net for individuals who are actively seeking employment.

Eligibility Requirements for Unemployment Benefits

To be eligible for unemployment benefits in Rhode Island, individuals must meet certain criteria. They must have earned a minimum amount of wages during a designated base period, which typically consists of the first four of the last five completed calendar quarters. Additionally, applicants must be able to work, available for work, and actively seeking employment. Individuals who were fired for misconduct or voluntarily quit their jobs without good cause may not be eligible for benefits.

Calculation Methods for Determining Benefit Amounts

The Rhode Island unemployment benefits are calculated based on the highest-earning quarter during the base period. The state uses a formula that considers an individual’s total wages earned during that quarter. The benefit amount is approximately 4.62% of the wages in the highest-earning quarter.

Maximum Weekly Benefit Amount in Rhode Island

The maximum weekly benefit amount (WBA) in Rhode Island is determined annually. As of 2021, the maximum WBA is $586. The WBA is based on the individual’s highest earnings during the base period and cannot exceed the set maximum.

Minimum Weekly Benefit Amount in Rhode Island

In Rhode Island, the minimum weekly benefit amount is $69. This minimum amount provides a base level of support for individuals with lower earnings during the base period. However, it is important to note that the actual benefit amount an individual receives may vary based on their earnings and other factors.

Duration of Unemployment Benefits in Rhode Island

The duration of unemployment benefits in Rhode Island is typically 26 weeks. However, during periods of high unemployment, the federal government may authorize additional weeks of benefits. This extension allows eligible individuals to receive financial support for a longer period while they actively search for new employment.

Additional Benefits for Dependents in Rhode Island

Rhode Island provides additional benefits for individuals who have dependents. Those with dependent children may be eligible for an additional amount to supplement their weekly benefit. The amount varies depending on the number of dependents.

Taxation of Unemployment Benefits in Rhode Island

Unemployment benefits are subject to federal income tax, and recipients may choose to have taxes withheld from their benefits. In Rhode Island, these benefits are also subject to state income tax. Recipients have the option to have state taxes withheld as well or make estimated tax payments to avoid owing taxes when they file their annual tax returns.

Reporting Requirements for Unemployment Recipients

Individuals receiving unemployment benefits in Rhode Island are required to file weekly claims, providing information about their job search activities and any income earned during that week. Failure to submit accurate and timely reports may result in a loss of benefits. It is important for recipients to understand and comply with the reporting requirements to ensure the continuation of their benefits.

Appeals Process for Denied Unemployment Benefits

If an individual’s unemployment benefits are denied, they have the right to appeal the decision. The appeal process involves submitting a written request for reconsideration within a specified timeframe. The appeal will be reviewed by an administrative judge who will decide whether to uphold or overturn the initial decision. It is crucial for individuals to carefully follow the appeals process to have a chance of receiving the benefits they are entitled to.

Resources and Support for Rhode Island Unemployed

Rhode Island offers various resources and support to unemployed individuals. The Department of Labor and Training (DLT) provides assistance in filing claims, understanding eligibility requirements, and accessing additional support services such as job training programs and career counseling. Additionally, the DLT website offers valuable information, including frequently asked questions, to guide individuals through the unemployment benefits process and facilitate a smoother transition to reemployment.

In conclusion, the unemployment pay in Rhode Island is designed to provide temporary financial assistance to individuals who experience job loss through no fault of their own. The program sets maximum and minimum weekly benefit amounts based on an individual’s highest earnings during the base period. Understanding the eligibility requirements, reporting obligations, and taxation of benefits is crucial for individuals to navigate the unemployment benefits system effectively. By accessing the resources and support available, unemployed individuals in Rhode Island can receive the assistance they need while actively seeking new employment.