Introduction to Unemployment Benefits in Rhode Island

Unemployment benefits serve as a crucial safety net for individuals who have lost their jobs and are unable to find new employment. In Rhode Island, the Department of Labor and Training administers the state’s unemployment insurance program. This program provides temporary financial assistance to eligible workers who have become unemployed through no fault of their own. Unemployment benefits help bridge the gap between jobs and provide vital support for individuals and their families during these challenging times.

Eligibility Criteria for Unemployment Benefits

To be eligible for unemployment benefits in Rhode Island, individuals must meet certain criteria. Firstly, they must have worked and earned a minimum amount of wages in employment covered by the state’s unemployment insurance program. They should have lost their job due to reasons that are not their fault, such as layoffs or business closures. Additionally, claimants must be actively seeking new employment and be available and able to work. Individuals who are self-employed or independent contractors may not qualify for regular unemployment benefits but may be eligible for other programs like the Pandemic Unemployment Assistance (PUA).

Calculating the Weekly Benefit Amount

The weekly benefit amount (WBA) is the monetary compensation individuals receive while they are unemployed. In Rhode Island, the WBA is calculated based on a percentage of an individual’s average weekly wage during a specific base period. The base period consists of the first four of the last five completed calendar quarters before the individual filed their claim. The current maximum WBA in Rhode Island is $586 (as of 2021). However, the actual amount received may vary based on an individual’s earnings during the base period.

Understanding the Maximum Benefit Amount

The maximum benefit amount (MBA) is the total amount of unemployment benefits an individual can receive during their benefit year. In Rhode Island, the MBA is equal to 26 times the individual’s weekly benefit amount. For example, if an individual’s WBA is $586, their MBA would be $15,236. It’s important to note that claimants cannot receive more in benefits than their MBA during their benefit year, even if they have not collected benefits for the full 26 weeks.

Duration of Unemployment Benefits in Rhode Island

Under normal circumstances, individuals in Rhode Island can receive unemployment benefits for a maximum of 26 weeks. However, during times of high unemployment, additional weeks of benefits may be provided through extended benefits programs. These programs are typically triggered when the state’s unemployment rate exceeds certain thresholds. It’s essential to stay updated on any changes or extensions to the duration of benefits through the Rhode Island Department of Labor and Training website.

Additional Benefits and Programs Available

Rhode Island offers several additional benefits and programs to support individuals who have lost their jobs. The state participates in the Federal Pandemic Unemployment Compensation (FPUC) program, which provides an additional $300 per week to eligible individuals who are receiving unemployment benefits. The Pandemic Emergency Unemployment Compensation (PEUC) program provides additional weeks of benefits to those who have exhausted their regular unemployment benefits. Moreover, the state offers job training and reemployment services to help claimants enhance their skills and find new employment opportunities.

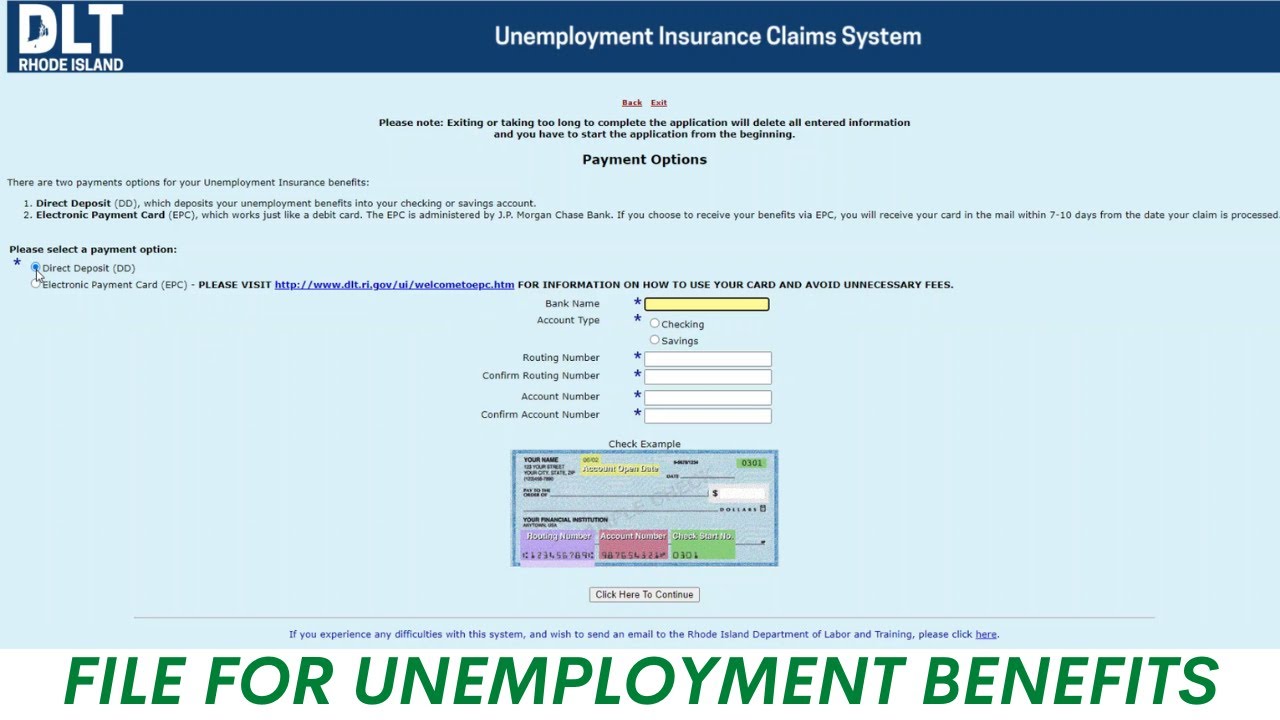

How to Apply for Unemployment Benefits

To apply for unemployment benefits in Rhode Island, individuals can file a claim online through the Rhode Island Department of Labor and Training website. The online application is available 24/7 and ensures a quick and efficient process. Alternatively, individuals can also file a claim by phone. It is crucial to gather all necessary information, such as personal details, employment history, and contact information, before starting the application process.

Required Documentation for Unemployment Claims

When filing an unemployment claim in Rhode Island, individuals will need to provide certain documentation to support their application. This includes their Social Security Number, driver’s license or state ID number, contact information, employment history for the past 18 months, and the reason for their job separation. Additionally, individuals may be required to provide documentation of their wages, such as pay stubs or W-2 forms. It is essential to ensure the accuracy and completeness of all information provided to avoid any delays or complications in the claims process.

The Appeals Process for Denied Benefits

If an individual’s unemployment benefits claim is denied, they have the right to appeal the decision. The appeals process in Rhode Island involves requesting a hearing before an appeals examiner. During the hearing, claimants can present evidence and witnesses to support their case. It is crucial to carefully review the denial letter and follow the instructions on how to appeal within the specified timeframe. Engaging the services of an attorney or a legal aid organization may be beneficial during the appeals process to navigate the complex procedures.

Taxation of Unemployment Benefits in Rhode Island

Unemployment benefits are generally considered taxable income by the federal government. In Rhode Island, unemployment benefits are also subject to state income tax. Claimants have the option to have federal and state taxes withheld from their benefit payments or make estimated tax payments on their own. It is advisable to consult with a tax professional or use online tax resources to understand the specific tax implications and obligations related to unemployment benefits.

Reporting Earnings While Receiving Benefits

Individuals receiving unemployment benefits in Rhode Island must report any earnings they receive during their benefit period. This includes wages from part-time or temporary work, self-employment income, bonuses, and severance pay. The state requires individuals to report their gross earnings for the week in which the work was performed, not when they receive the payment. Failing to report earnings accurately or neglecting to report them altogether may result in penalties or even the requirement to repay benefits received.

Frequently Asked Questions about Unemployment Benefits

-

Can I work part-time and still receive unemployment benefits in Rhode Island?

Yes, individuals can work part-time while receiving benefits, but their earnings may affect the amount they receive. It is important to report all earnings accurately to the Rhode Island Department of Labor and Training. -

What happens if I refuse a job offer while receiving unemployment benefits?

Refusing a suitable job offer without valid reasons may result in the denial of unemployment benefits. It is crucial to carefully consider job offers and consult with the Department of Labor and Training if unsure. -

How long does it take to receive unemployment benefits after filing a claim?

The processing time for unemployment benefits can vary, but claimants can typically expect their first payment within two to three weeks after filing a claim. -

Can self-employed individuals receive unemployment benefits in Rhode Island?

Self-employed individuals may not be eligible for regular unemployment benefits but may qualify for the Pandemic Unemployment Assistance (PUA) program if they meet the specified criteria. -

How often do I need to certify for unemployment benefits in Rhode Island?

Claimants must certify for benefits on a weekly basis, usually on Sundays. This involves confirming their continued eligibility and reporting any earnings for the previous week.

By understanding the eligibility criteria, calculation methods, duration, and additional programs available, individuals in Rhode Island can navigate the unemployment benefits system more effectively and access the vital financial support they need during times of unemployment.