Introduction to TDI in Rhode Island

Temporary Disability Insurance (TDI) in Rhode Island is a state-run program that provides temporary income replacement to eligible workers who are unable to work due to a non-work-related illness or injury. This program is designed to help individuals maintain financial stability during their period of disability, ensuring that they can meet their essential needs and focus on their recovery without financial distress.

Eligibility criteria for TDI in Rhode Island

To be eligible for TDI benefits in Rhode Island, workers must have earned a certain amount of wages during their base period. The base period is determined by the calendar quarter in which the disability began and the three preceding quarters. Additionally, individuals must be medically certified as unable to work by a licensed healthcare provider. They must also be actively employed or have been employed within the previous 12 months.

Application process for TDI benefits in Rhode Island

To apply for TDI benefits in Rhode Island, individuals need to complete and submit the TDI application form. This form can be obtained from the Rhode Island Department of Labor and Training website or by visiting a local TDI office. The application requires personal information, including employment history, medical certification, and a signature. It is important to provide accurate and detailed information to avoid delays in processing the application.

Determining TDI benefit amount in Rhode Island

The benefit amount for TDI in Rhode Island is calculated based on the individual’s average weekly wage during the base period. The current formula takes the highest-paid quarter of the base period and divides it by 26 to determine the weekly benefit amount. There is a maximum weekly benefit limit set by the state, which is adjusted annually. The amount received from TDI is subject to federal income tax but is exempt from state income tax.

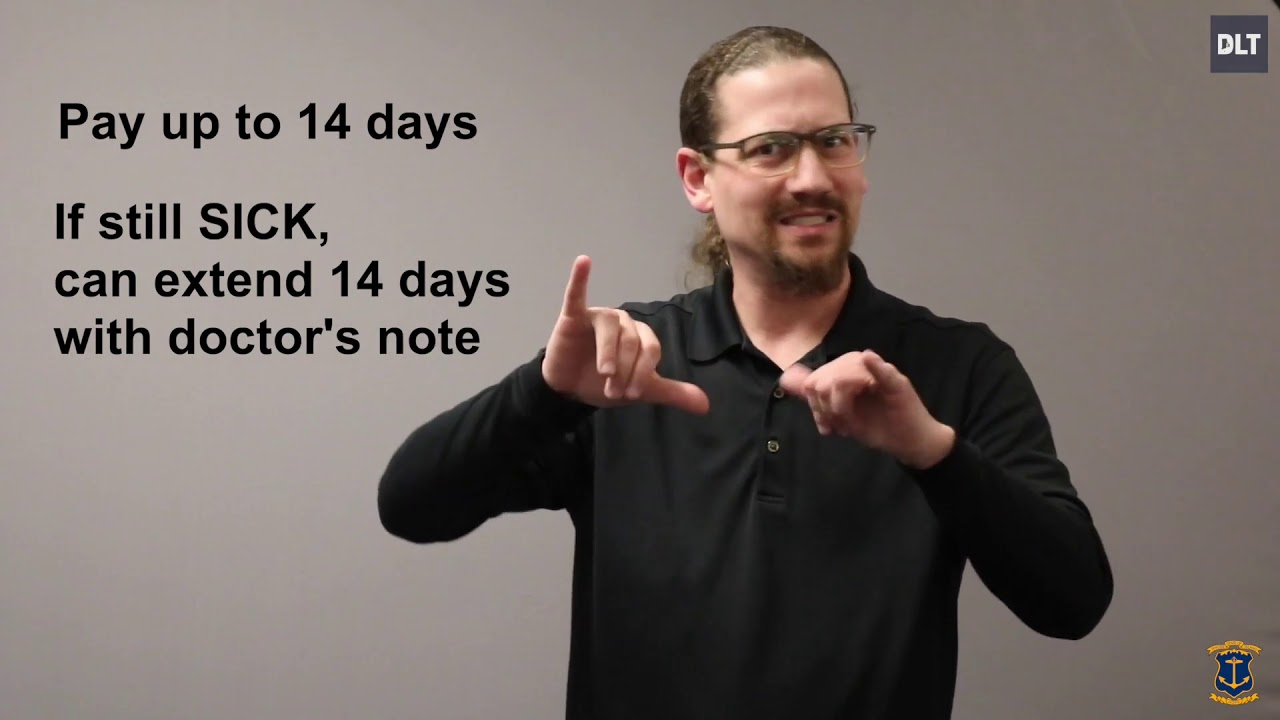

Duration of TDI benefits in Rhode Island

TDI benefits in Rhode Island can be provided for up to 30 weeks within a benefit year. A benefit year is a consecutive 52-week period that starts on the Sunday of the week in which the claim is filed. The duration of benefits depends on the severity of the disability and the length of time the individual is unable to work. It is important to note that benefits cannot exceed the maximum available amount for the benefit year.

Document requirements for TDI claims in Rhode Island

When filing a TDI claim in Rhode Island, it is necessary to provide certain documents to support the application. These documents may include medical records, a completed medical certificate, employment history, and other relevant paperwork. It is crucial to submit accurate and complete documentation to avoid delays or potential denials of benefits. Additional documentation may be requested during the review process.

Employer responsibilities under TDI in Rhode Island

Employers in Rhode Island are required to provide their employees with TDI information and notify them of their rights and responsibilities under the program. They must also provide necessary documentation, such as wage and employment verification, to support their employees’ TDI claims. Employers are responsible for maintaining communication with their employees during their period of disability and facilitating a smooth transition back to work.

Employee responsibilities under TDI in Rhode Island

Employees who are receiving TDI benefits in Rhode Island have certain responsibilities. They must promptly notify their employer of their disability and provide any required documentation. Individuals must also follow their healthcare provider’s treatment plan and cooperate with any medical or vocational evaluations requested by the Department of Labor and Training. It is important for individuals to report any changes in their medical condition or work status to the TDI office.

Appeals process for TDI denials in Rhode Island

If a TDI claim is denied in Rhode Island, individuals have the right to appeal the decision. The appeals process involves filing a written notice of appeal within a specified timeframe and providing any additional information or documentation to support the claim. The case will then be reviewed by an appeals referee who will make a determination based on the evidence presented. If the decision is still unfavorable, individuals can further appeal to the Rhode Island District Court.

Returning to work while on TDI in Rhode Island

Individuals receiving TDI benefits in Rhode Island may return to work on a part-time basis while still receiving partial benefits. This allows individuals to gradually transition back into the workforce while still receiving the necessary support. The TDI program provides guidelines for reporting earnings to ensure accurate benefit calculations. It is important to notify the TDI office of any changes in work status to avoid potential overpayments or penalties.

Coordination between TDI and other benefits in Rhode Island

TDI benefits in Rhode Island may be coordinated with other social security benefits, such as Social Security Disability Insurance (SSDI) or workers’ compensation. Coordination ensures that individuals do not receive duplicate benefits and that their overall income remains within the appropriate limits. It is important to notify the relevant agencies of any changes in benefit status to avoid potential overpayments or complications.

Frequently asked questions about TDI in Rhode Island

-

Can I apply for TDI benefits if my illness or injury is work-related?

No, TDI in Rhode Island only provides benefits for non-work-related illnesses or injuries. -

Are TDI benefits taxable?

Yes, TDI benefits are subject to federal income tax but are exempt from state income tax in Rhode Island. -

Can I receive TDI benefits if I am self-employed?

No, self-employed individuals are not covered by TDI in Rhode Island. They may consider other options, such as private disability insurance. -

How long does it take to receive TDI benefits after submitting an application?

The processing time for TDI benefits in Rhode Island can vary, but it is typically within a few weeks after the application is submitted. -

Can I receive TDI benefits if I am receiving unemployment benefits?

No, individuals cannot receive both TDI and unemployment benefits simultaneously in Rhode Island. -

What happens if my TDI claim is denied?

If your TDI claim is denied, you have the right to appeal the decision. Follow the appeals process outlined by the Rhode Island Department of Labor and Training. -

Can I receive TDI benefits if I am out of state during my disability?

Yes, individuals who are temporarily out of state during their disability can still receive TDI benefits as long as they meet the other eligibility criteria. -

Do I need to use my sick or vacation leave before applying for TDI benefits?

No, individuals are not required to use their sick or vacation leave before applying for TDI benefits in Rhode Island. -

Can my employer terminate me while I am on TDI?

Employers cannot terminate employees solely because they are on TDI. It is important to know and understand your rights as an employee. -

Are there any resources available to help me understand the TDI process in Rhode Island?

Yes, the Rhode Island Department of Labor and Training provides resources, including brochures and a website, to help individuals understand and navigate the TDI process.